The most effective Method Of Calculating Depreciation For Tax Reportin…

페이지 정보

본문

If an asset didn’t price a lot, it makes little sense to depreciate it. There's nobody finest technique of calculating depreciation for tax reporting functions. Each strategy has its merits and could be the most suitable for a particular asset and state of affairs. That mentioned, most often, the straight-line technique is the go-to choice. It is the best and most consistent strategy to calculate depreciation and is the logical selection when dealing with an asset whose value decreases steadily over time at round the same rate. So, in case you are in search of a financing resolution to suit your wants, listed here are five causes to choose a lease. What's an Working Lease? An operating lease is a form of financing supplied to businesses that enables them to acquire crucial equipment with out buying it. The price of the tools is slightly unfold out and paid in monthly installments till the tip of the time period when the tools is often returned to the lessor. Making the best decision between capital and working leases is important for companies to handle funds effectively. These two lease sorts differ of their accounting therapy, monetary implications, and operational concerns. This guide breaks down their distinctions to help you classify leases precisely and select the perfect option for your business needs.

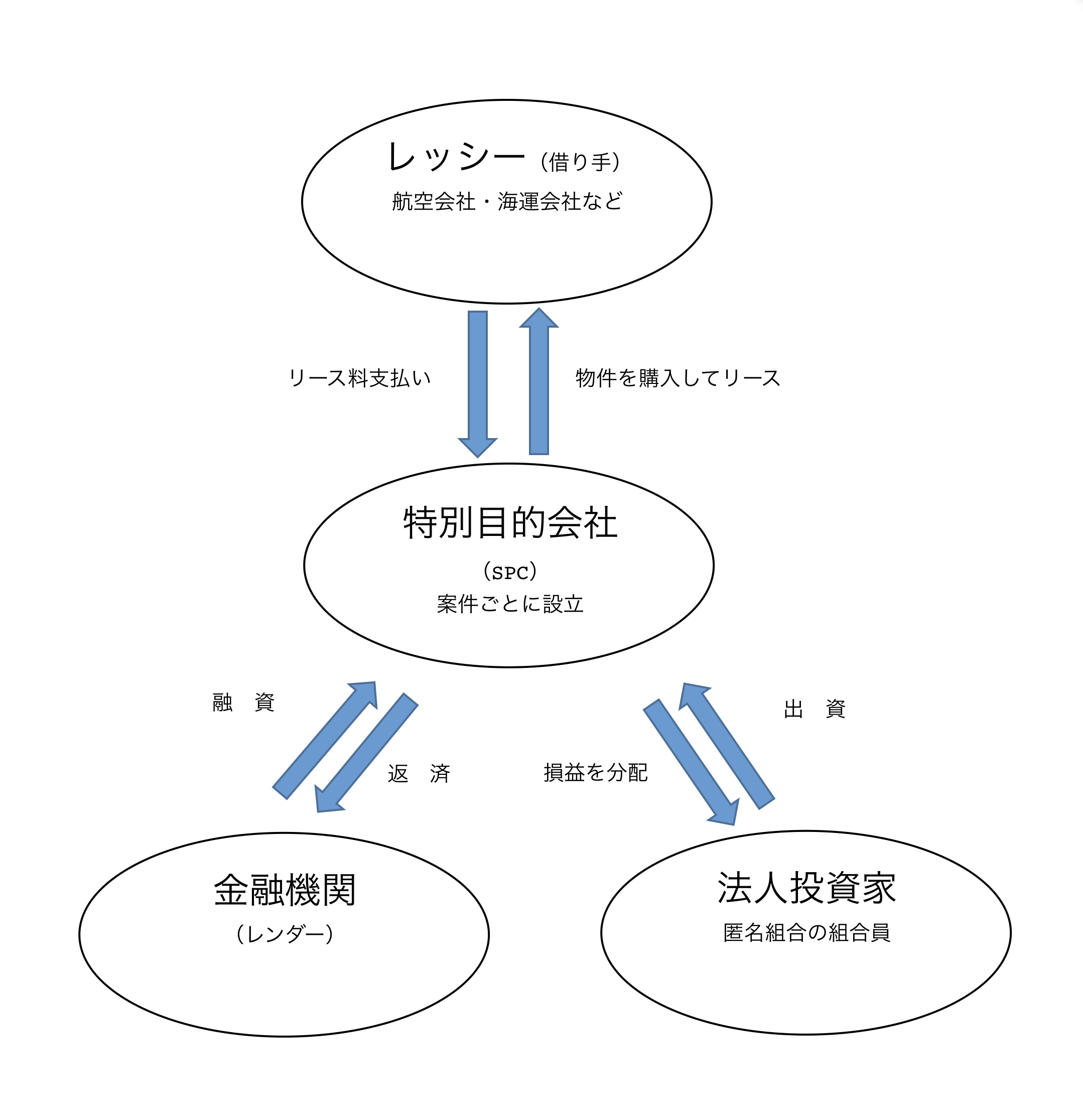

This can simplify the tax reporting course of and supply further tax savings. For example, suppose an organization leases a chunk of gear by means of a leveraged leasing structure. 200,000 of its personal funds. Under this situation, the lessee would be in a position to claim depreciation deductions on the leased equipment, although they don't personal it. They'd also be able to assert interest deductions on the lease funds made to the lessor.

Capital beneficial properties happen while you promote or transfer a property for a worth increased than the adjusted value base of the property. In contrast, capital losses occur whenever you dispose of assets at a decrease value than the adjusted cost base, together with any selling prices. Should you incurred a capital loss during the yr, you should utilize it to cut back your capital gains in the same 12 months. Your allowable capital loss will be equal to half of your loss. You can use this to offset any capital positive aspects you may have made in the same year, lowering your taxable earnings. It doesn’t account for changes in an asset’s productivity or worth over time. For オペレーティングリース 節税スキーム tax functions, other strategies could be more advantageous in certain situations. By mastering the straight-line technique, you’ll have a reliable instrument for calculating depreciation expense that aligns with accounting standards and provides a clear image of your assets’ declining value over time. This method’s simplicity and consistency make it a wonderful starting point for business owners seeking to implement a depreciation strategy. The declining balance methodology gives an adaptable method to depreciation, reflecting the speedy loss of value many assets experience of their preliminary years of use. This technique is particularly appealing to enterprise house owners searching for a more nuanced method to asset depreciation. Accelerated depreciation methods, like the declining steadiness strategy, allocate a bigger portion of an asset’s value to depreciation expense in the earlier years of its useful life. This approach typically aligns more carefully with the actual depreciation sample of many assets, especially expertise and vehicles.

Alternatively, expenses to keep up the property are only deductible while the property is being rented out - or actively being advertised for rent. This contains things like routine cleansing and maintenance bills and repairs that keep the property in usable condition. Part 1250 is only related for those who depreciate the worth of a rental property using an accelerated methodology, after which promote the property at a revenue. By spreading the dangers associated with the acquisition and possession of an asset across a number of parties, leveraged leasing can decrease the potential for losses and permit companies to benefit from alternatives that might in any other case be too risky. 1. Diversifying risk - In a leveraged lease, the risk of asset possession is unfold across multiple parties, including the lessor, the lessee, and the lender.

Make the most of the overseas tax credit mechanism to keep away from double taxation on the same revenue, and receive tax certificates from the foreign tax authorities. Monitor the tax compliance obligations and deadlines, and file the tax returns and pay the tax on time. Search professional advice and guidance from tax specialists and consultants, and keep abreast of the newest developments and updates on the UAE CT system. Are you in search of corporate tax planning in the UAE? HHS Lawyers in Dubai is a legislation agency in UAE that may make it easier to with that. Our tax consultants have in-depth data of the UAE tax laws and regulations, in addition to worldwide tax requirements and treaties. We will provide help to optimize your tax legal responsibility, adjust to the legislation, and avoid pointless risks.

- 이전글An Analysis Of 12 Bob Strategies... This is What We Realized 24.12.28

- 다음글Understanding Sports Betting within the USA: Trends, Regulations, and Future Prospects 24.12.28

댓글목록

등록된 댓글이 없습니다.